Understand

Open banking APIs for sustainability: an open ecosystem approach

Why a digital open ecosystem approach is essential to addressing the climate crises

An open ecosystem approach is essential to addressing complex, global challenges including the climate crises. Work at both global and local levels, and at scale, requires collaboration amongst stakeholders that goes beyond one-off or individual partnership arrangements.

Working effectively to solve climate crises and environmental challenges will require the following open ecosystem components:

- Digital infrastructure: Bodies like the United Nations Environment Program have outlined models to build a global digital data ecosystem to facilitate greater use of data and APIs. Current debates about the lack of access to global energy data, for example, need to be resolved by making use of digital infrastructure platforms that can remove paywalls from access to essential datasets. Developer-focused infrastructure platforms like Postman are starting to group APIs that can be used to address climate change into open collections, and scale-ups like Switch Automation, which works on enabling digital facilities management, are aggregating APIs related to commercial buildings management to enable single views of environmental and sustainability impacts of buildings.

- Open standards: Agreement on common ways to define data, build APIs, share details of how algorithms are created, and so on enables collaboration at scale.

- Common data models: In addition to (or as a subset of) open standards, common data models are also needed so that individual stakeholders are creating datasets that can be shared to coordinate, facilitate cooperation, and enable complementary and collaborative actions. (Sidenote: We have specific definitions of what we mean by each of these types of ecosystem relationships.)

- Data governance structures: Encouraging collaboration while protecting personal and sensitive data, overseeing equity-based solutions, and enabling market competition amongst stakeholders will require new types of data governance structures including data privacy regulations, equity impact assessments, data sharing agreements, open standards authorities, networking bodies, and so on. The Brookings Institute’s Interoperable, agile, and balanced: Rethinking technology policy and governance for the 21st century Working Paper spells out modern governance regulatory approaches that will be needed to rein in the market power imbalances and risks emerging from big tech-dominant influence on policy. These make an ideal checklist of governance processes needed for open ecosystems.

Fostering open ecosystems for sustainability will require the above components, alongside work to advance sustainable IT more generally. Current progress on shifting towards sustainable IT architecture was recently described by API industry journalist Jennifer Riggins in her piece for The New Stack. API community hub apidays also works annually on supporting innovative projects through their annual Digital Sustainability Challenges. These initiatives, and those like the Finnish TIEKE’s project to accelerate carbon-neutral digital services, are urgently needed. Working towards sustainable IT is crucial, especially given the accelerating rate of digitalisation.

(Source: https://tieke.fi/en/greenictkickoff/)

APIs and digital tools as building blocks of open ecosystems

The world’s core services infrastructures are becoming increasingly digital, a move that has been accelerated by the COVID-19 pandemic. Application programming interfaces (APIs) are a key component in these open, modern and agile digital service infrastructures. The modular nature of APIs supports open ecosystems to grow (alongside other digital tools like open source technologies, access to data, and open standards). In turn, this allows faster innovation as products and solutions can be built from reusable web services, datasets, algorithms, and other digital components.

How open banking/open finance ecosystems could support open sustainability efforts

Platformable is taking a climate mainstreaming approach, as outlined by the European Union’s budget approach since 2014. For the EU, this meant that “programmes in all policy areas [need] to consider climate priorities in their design, implementation and evaluation phases.” For us at Platformable, to start our work on open sustainability, we are focusing on how our most mature ecosystem program area — open banking/open finance — could be leveraged to support sustainability efforts.

We drew on three main sources to consider how to define the opportunities for using open banking/open finance APIs to aid open sustainability:

- Platformable’s open banking/open finance value model which describes how value flows and is distributed in open banking/open finance ecosystems

- The Greenfintech Alliance taxonomy which defined seven categories of green fintech products, and

- The European Commission’s draft taxonomy for sustainable activities, which begins to describe how impacts should be measured against six key sustainability areas of focus.

This allowed us to conceptualise how open banking and open finance APIs could be enlisted to drive sustainability efforts:

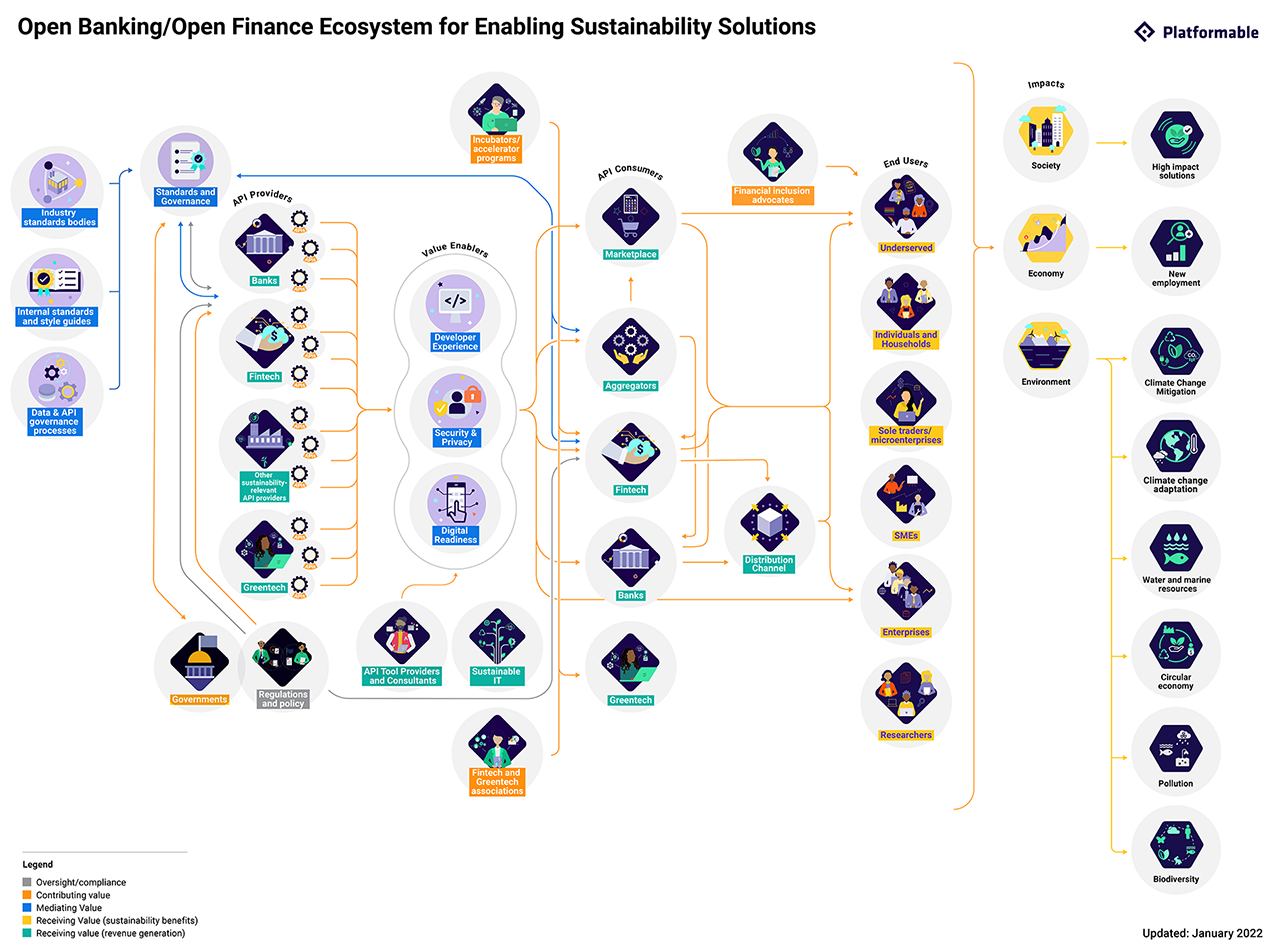

While a followup article will describe this model in detail, from left to right, API providers (including banks, fintech and other environmental data providers) make APIs available, which are used by API consumers (such as fintech, API aggregators and greentech) to build new products and services which are then used by individuals, businesses, enterprises and researchers to take action to improve sustainability. In turn, these actions lead to impacts on society, local economies and the environment.

Bank and fintech stakeholders are beginning to take an active role:

- Commerzbank’s white paper released last year, How API-based Ecosystems Can Serve the Circular Economy, notes “ecosystems based on APIs are going to be integral in the transformation from traditional economy models into new business models, as they are founded through collaboration. They will not only allow for sustainable services but also reusing and sharing already established competencies and services between participants – as in a circular economy business model.”

- Monika Liikamaa from Enfuce describes how their transaction-based carbon calculator allows the financial industry to act. My Carbon Action is offered via an API to banks, financial institutions and merchants, and based on payment data and country-specific datasets calculates the carbon footprint for payment transactions.

- Richard Harmerton-Stove from 11:FS, describes some potential use cases if banks were to make use of available APIs that build carbon calculators on top of bank account transaction data. While inspiring, Harmeton-Stove focuses on individual behavior change and suggests carbon calculator feature-sets could include opportunities for individual consumers to set targets on the carbon footprint of their spending. But use cases for open banking and open finance APIs to drive sustainability efforts could go well beyond focusing primarily on individual behaviour change, which has limited impact on major causes of greenhouse gas emissions if not done in combination with industry and business-led changes. Even for individual behaviour change, carbon calculators need to go beyond simply tracking carbon footprints and enable in-app changes in behaviour: the ability to switch energy company or electricity plans (to a greater combination of renewable sources, for example) from within the calculator.

- As noted by Kris Dickinson at NayaOne, carbon calculators represent the “first-mover pull” for many financial institutions to start building sustainable products. Dickinson argues that as consumer demand grows, “use cases will grow rapidly.”

The first edition of our Open Banking and Open Finance for Sustainability Trends Report — covering over 100 European and UK initiatives — will be launched on 15 February 2022.

Sign up here to receive your copy:

To join us in our Open Sustainability ecosystem work, check out our Open Sustainability product pages and get in touch.

Mark Boyd

DIRECTOR